Live updates: Australian share market to fall, Wall Street gains as Apple pledges $154b US investment

Trump imposes an additional 25% tariff on Indian goods

US President Donald Trump has issued an executive order on Wednesday imposing an additional 25% tariff on goods from India, saying the country has imported Russian oil.

Oil prices seesawed and finished down, as Trump’s remarks about progress in talks with Moscow created uncertainty on whether the US would impose new sanctions on Russia.

The White House order did not mention China, which is another big purchaser of Russian oil.

Last week, US Treasury Secretary Scott Bessent warned China that it could also face new tariffs if it continued buying Russian oil.

With Reuters

Quest for agelessness drives longevity boom

Cryotherapy, infant stem cells, extreme cold, IV infusions, red light therapy, blue light therapy … more Australians are paying big bucks to buy into a “longevity” industry worth an estimated $2.5 trillion globally — and that has some traditional doctors worried.

Read more from business reporter Nadia Daly.

Warnings RBA’s move to end card surcharges could hike banking costs

The Reserve Bank has proposed an end to card surcharges, but similar moves overseas have led to higher banking costs.

Experts say a cap on interchange fees will cost banks $900 million, which they are likely to recoup via higher card costs or devalued rewards points.

Banks and other stakeholders have until the end of the RBA’s consultation period on August 26 to make submissions.

Read more from business reporter Emily Smith.

ICYMI: Alan Kohler’s Finance Report

Trump says US will charge tariff of about 100% on semiconductor imports

The United States will impose a tariff of about 100% on semiconductor chips imported into the country, President Donald Trump said on Wednesday.

Trump told reporters in the Oval Office that the new tariff rate would apply to “all chips and semiconductors coming into the United States,” but would not apply to companies that had made a commitment to manufacture in the United States.

“So 100% tariff on all chips and semiconductors coming into the United States. But if you’ve made a commitment to build (in the US), or if you’re in the process of building (in the US), as many are, there is no tariff,” Mr Trump said.

Reporting by Reuters

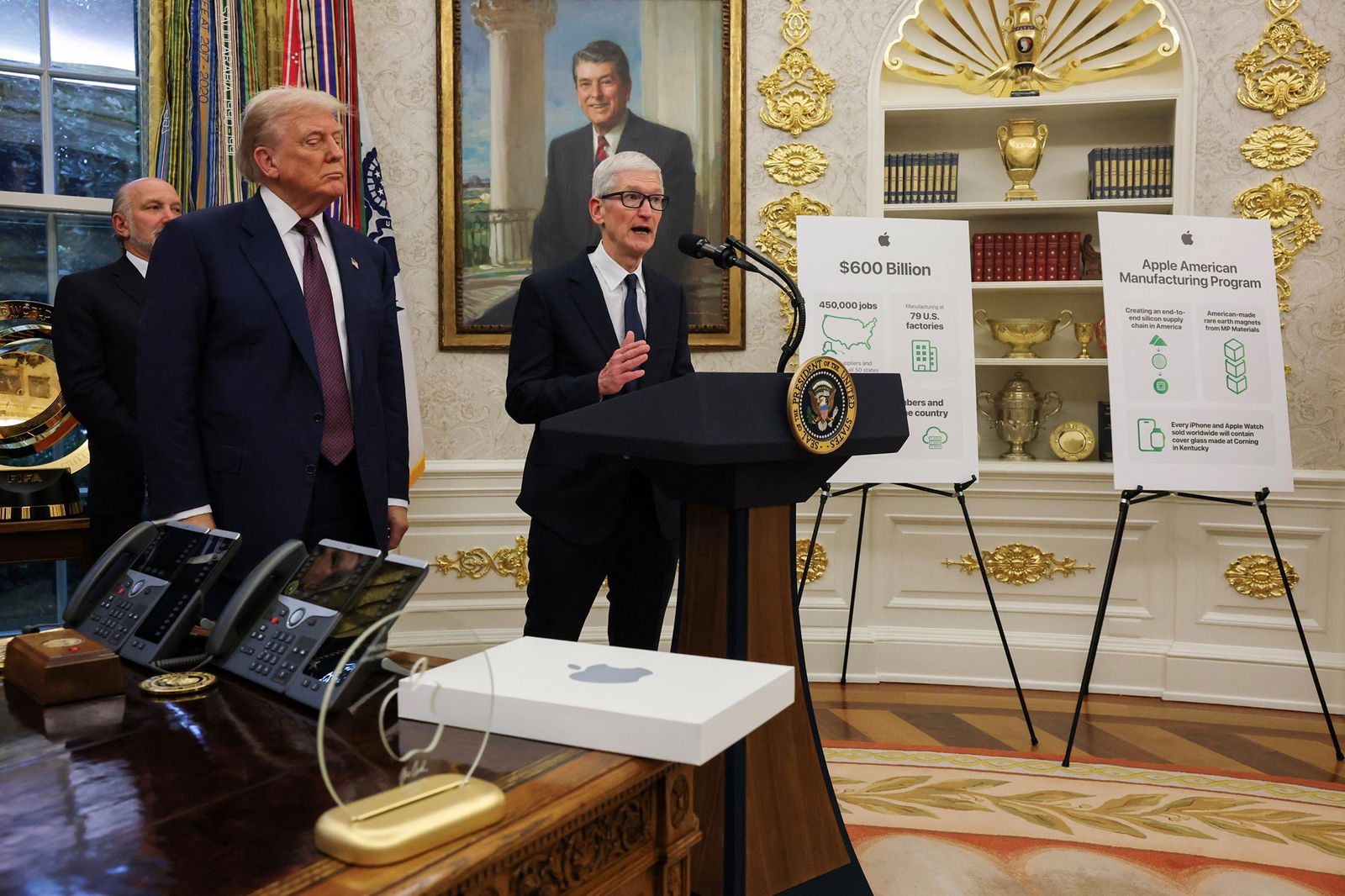

Apple’s $154-billion pledge boosts Wall Street

US stocks ended higher on Wednesday, led by a more than 1% gain in the Nasdaq, as Apple shares climbed after the announcement of a domestic manufacturing pledge, and as some companies delivered upbeat earnings reports.

Shares of Apple jumped 5.1% and provided the biggest boost to all three of the major indexes after company announced a $154-billion domestic manufacturing pledge.

It comes as President Trump pursues an aggressive tariff and trade agenda aimed at moving some manufacturing back into the United States.

Apple said in February it would spend $769 billion in US investments in the next four years that will include a giant factory in Texas for artificial intelligence servers while adding about 20,000 research and development jobs across the country.

Trump’s tariffs cost Apple $1.2 billion in the June quarter and spurred some customers to buy iPhones in late spring this year.

Apple has been shifting production of products bound for the US, sourcing iPhones from India and other products such as Macs and Apple Watches from Vietnam.

In addition, shares of McDonald’s rose 3% after the fast-food restaurant’s affordable menu drove global sales past expectations, while Arista Networks shares jumped 17.5% after the cloud networking company projected current-quarter revenue above estimates.

“Earnings continue to come in better than expected,” said Sam Stovall, chief investment strategist at CFRA Research.

He said while there is uncertainty surrounding tariffs, investors appear to be upbeat about the near term.

Results are now in from about 400 of the S&P 500 companies for the second-quarter earnings season.

About 80% of reports are beating analyst earnings expectations – above the 76% average of the last four quarters – and earnings growth for the quarter is estimated at 12.1%, up from 5.8% at the start of July, according to LSEG data.

with Reuters

ASX to fall

Good morning and welcome to Thursday’s markets live blog, where we’ll bring you the latest price action and news on the ASX and beyond.

Wall Street has ended the session higher with Nasdaq up more than 1%.

The Dow Jones index gained 0.2 per cent, the S&P 500 advanced 0.7 per cent.

ASX futures were down 27 points or 0.3 per cent to 8,779 at 7:00am AEST.

At the same time, the Australian dollar was flat at 65.02 US cents.

Brent crude oil was down 1.2 per cent, trading at $US66.84 a barrel.

Spot gold dropped 0.4 per cent to $US3368.80.

Iron ore shed 0.5 per cent to $US101.95 a tonne.