Markets live updates: Reserve Bank expected to keep interest rates on hold, Seven West and Southern Cross Media propose merger

Market snapshot

- ASX 200 futures: +0.7% to 8.904 points

- Australian dollar: Flat at 66.73 US cents

- Dow Jones: +0.1% to 46,316 points

- S&P 500: +0.3% to 6,661 points

- Nasdaq: +0.5% to 22,591 points

- FTSE: +0.2% to 9,299 points

- EuroStoxx: +0.2% to 555 points

- Spot gold: +1.4% to $US3,862/ounce

- Brent crude: -3.9% to $US63.18/barrel

- Iron ore: -0.1% to $US105.35/tonne

- Bitcoin: +3.2% to $US114,257

Prices current around 7:45am AEST

Live updates on the major ASX indices:

What’s the upside?

Media companies are in a whirl at the moment, continuing to lose audience and attention to digital rivals with billion-dollar tech expertise and global ambitions that outspan and outspend borders and laws.

Can they keep audience, attention and the key thing, the advertising revenue that comes from having those things, to survive and thrive in the second quarter of this century?

Unsurprisingly, Seven West Media and Southern Cross Media think the answer is a big YES.

Here’s Heith Mackay-Cruise, Chairman of SCA, who will take over from Seven supremo Kerry Stokes.

“This merger will create a leading integrated Total TV, Audio and Digital platform, with the scale, reach and diversification to better serve Australian leading brands on broadcast and digital platforms establishes an indisputable leader across the critical 25-54 ‘audience that matters’ demographic.”

Why do they matter the ‘most’? They spend the most money and advertisers want to reach them.

“The merged entity will offer partners and clients a ‘one stop shop’ for opportunities to reach this valuable audience across all mediums, leveraging shared content and commercial opportunities to add value beyond the initial cost synergy estimates.

“The SCA Board has carefully considered this transaction and firmly believes that this proposal is in the best interests of the SCA shareholders. We are confident the merger has the potential to create significant value for SCA shareholders.”

Time will tell.

Come for the rates analysis, stay for the information on iconic literary texts

I hate to be insufferable (though not enough to change my ways.) But in Dante’s Inferno, the basis for most modern depictions of hell (since biblical depictions aren’t really discriptive) Satan is trapped in a frozen lake in the deepest circle of hell. He probably /would/ benefit from an overcoat. Guess that means there’ll be a rate cut today 😛

– D.C

In his great read on what’ll happen to rates today, ABC Business Editor Michael Janda said “there’s about as much chance of Satan needing an overcoat as there is of the RBA lowering its cash rate today.”

But DC says we need to re-read the classic!

(I haven’t read it, so will defer on depictions to people who have either read the text or been to hell).

Seven West and Southern Cross shares leap on merger deal

The local share market is open, with the ASX 200 up 0.1% so far.

Seven West Media shares have gained 8.9% while Southern Cross media shares are up 7.1%.

Green investors undeterred by Trump’s claims of climate change being a ‘hoax’

Despite the US government’s unwillingness to address climate change, the Clean Energy Investor Group’s chief executive Richie Merzian believes it won’t derail the rest of the world’s efforts to decarbonise.

Loading…

He’s interviewed here by The Business’ David Chau.

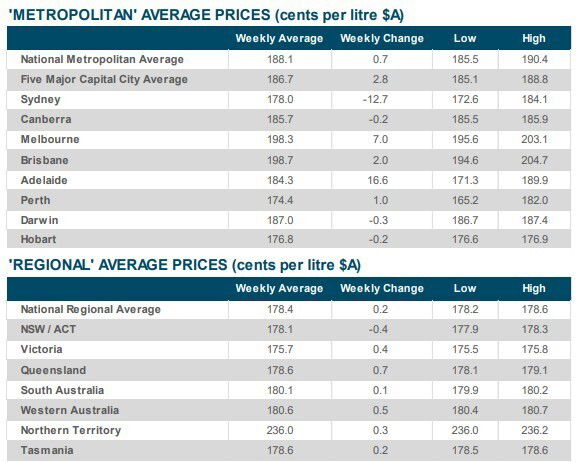

What is petrol costing where you are?

OK, so the national average price of a litre of unleaded petrol is up 0.5 cents to 184.9 cents in the week to Sunday.

But what you really want to know is what it’s like where you live?

And thanks to the dedicated boffins at the Australian Institute of Petroleum, here’s that very data.

Kerry Stokes out in Seven/SCA merger deal

Media magnate Kerry Stokes will stand down as chair of Seven West Media as part of a $400 million tie-up that brings radio networks Triple M and Hit together with the Seven Network.

Here are some of the key points:

- Jeff Howard – currently Managing Director and CEO of SWM -will lead the combined group as chief executive.

- Kerry Stokes would become chairman before stepping down in February 2026 and handing over to Heith Mackay-Cruise, who is currently chair of SCA

- Shareholders in Southern Cross Media would own around 50.1% of the combined company if the deal, which is structured as a scheme of arrangement, completes. The board of SGH, which owns 40.2% of Seven West Media, has signaled it supports a deal.

Here’s outgoing Seven West chairman Kerry Stokes:

“This is an important merger, as the combined company will be better able to serve both metropolitan and regional viewers, listeners, partners and advertisers.”

Petrol up 0.5 cents in a week

The national average price of a litre of unleaded petrol lifted 0.5 cents to 184.9 in the week to Sunday.

Weekly data from the Australian Institute of Petroleum details the rise, which puts the average above the 12-month average figure of 179.7 cents.

Seven West Media and Southern Cross to merge

Seven West Media – which owns the Seven Network and the ‘West Australian’ newspaper – and Southern Cross Media have agreed on a merger.

More to come.

Market set to open: here’s the state of play

Ever-reliable Kyle Rodda of Capital.com has his summary of where we’re at ahead of the stock market opening at its usual time of 10AM on the eastern coast.

- Wall Street edges higher after Friday’s benign inflation data

- Oil prices plunge on OPEC+ output plans, gold hits new record

- The RBA is expected to hold rates steady, focus on guidance

What’s going on? Let’s look at the US markets first.

“Wall Street edged higher, following through from the post-PCE Index data move on Friday night. Enthusiasm was curbed by fresh dysfunction in the US government. Another shutdown looms, with Congress having only a couple of days to pass a funding bill to keep a myriad of federal services running. The most immediate implication for the markets is the shut down may delay the release of certain data, including the critical Non-Farm Payrolls report.

“In the bigger picture, some within the Trump administration and Congressional Republicans are threatening to permanently lay-off swathes of workers if a deal does not get done, threatening to put thousands out of work.

“At the margins, that would put upward pressure on unemployment and weaken economic activity. The primary focus for market participants is currently the path forward for US interest rates, with asset prices being supported by the notion that cuts are coming and they could end up being relatively deep.

“As the markets await the beginning of the final quarter of the year, the odds remain skewed to another Fed cut in October and December. The odds for a December move have diminished, however, largely due to some cautious language coming from Fed officials in the past week. The markets are ascribing a 68% implied probability of a cut at that meeting, down from over 80% last week. A soft or benign Non-Farm Payrolls report on Friday will help lift those odds. That is, of course, if the data is released at all this week.”

Oil price slump

“Commodity markets were also in focus last night, with big moves in gold and oil. Gold hit another record high, with the drivers multi-faceted but largely due to expected Fed cuts next year and the belief that economic policy may pose upside risks to inflation going forward.

“Crude prices also plunged on reports that OPEC are preparing another output hike for November to be announced at its upcoming Joint Ministerial Monitoring Meeting. The soft demand backdrop for crude isn’t deterring the cartel from increasing output, which is seemingly prioritising market share and volumes over price and revenues. The hikes will add to an existing glut in the market, potentially driving WTI towards key support at $US61.50.”

RBA interest rate decision due at 2:30pm AEST

If you’re wanting to stay across what happens with interest rates today, you’re in the right place.

What’s expected? Not a lot, really.

Market pricing and economist forecasts suggest the cash rate will remain on hold at 3.6%.

Nevertheless, the statement and governor’s press conference will be closely watched for any hints about where to from here for the RBA’s easing cycle.

We’ll have full coverage here on the blog and across other ABC platforms:

- 2:30pm AEST: RBA interest rate decision released

- 3:30pm AEST: RBA governor Michele Bullock press conference

It’s worth also noting that on the RBA website, there are no speeches by the governor or other officials scheduled over the next fortnight, until assistant governor for economics Sarah Hunter speaks in mid-October.

There are two further monetary policy board meeting scheduled this year, in early November and December.

Stick with us!

Loading

Auditors not adequately challenging valuations: ASIC

ASIC‘s review of audit files found that auditors are not doing enough to obtain sufficient audit evidence about investment valuations in superannuation funds‘ financial reports.

Given the size of Registerable Superannuation Entities (RSEs), auditors adopted high levels of materiality, which can result in less audit work and variances not being investigated.

“We found that some auditors also did not adequately challenge the valuations provided by fund managers of managed investment schemes,” ASIC commissioner Kate O’Rourke said.

“This could undermine member confidence in the accuracy of financial information about their super fund.

“We issued comment forms to four auditors setting out our findings and will continue to work with them to resolve our concerns.”

Major audit firms fail in keeping a check on super funds: ASIC

Major audit firms including BDO, Deloitte, Ernst & Young, KPMG and PricewaterhouseCoopers may have let down consumers in their financial reporting and audit of super funds, according to corporate watchdog ASIC.

The regulator has conducted surveillance activities to ensure that into the financial reporting and audit of Registerable Superannuation Entities (RSEs) is up to standards.

ASIC’s review looked into the financial reports from 60 registerable superannuation entities for the year ending June 30, 2024.

It contacted 17 of these for additional information.

ASIC does not name the 60 registerable superannuation entities RSEs in the report, but confirmed it covers Australia’s biggest super funds.

ASIC also conducted an audit surveillance on one RSE audit file at each of the following five audit firms: BDO, Deloitte, Ernst & Young, KPMG and PricewaterhouseCoopers.

The surveillance identified an inconsistent approach to disclosing investments, limited disclosure of sponsorship and advertising expenses, and insufficient audit evidence obtained in the valuation of some investments.

“High quality audited financial reports underpin members’ confidence in the accuracy of information about the super funds that safeguard their retirement savings,” ASIC commissioner Kate O’Rourke said.

“However, when trustees and auditors do not adequately perform their roles as gatekeepers, there is a potential risk of misstatement of asset values.

“Super trustees must have appropriate governance arrangements to assist with the preparation of high-quality financial reports, while auditors must perform independent audits in accordance with the relevant auditing and assurance standards.”

💬How are you feeling about interest rates?

Whether you’re a home owner with a mortgage, a saver, a renter, a would-be buyer, a retiree or anyone in between, let us know how you’re feeling about interest rates at the moment.

Join the conversation by leaving us a comment above ⬆️

Why is Optus in hot water? Deaths and Dapto

The leadership (local and Singaporean) of telco Optus are meeting Communications Minister Anika Wells today, in what will be a tough moment for the embattled company.

Loading…

Optus has been in the frame of public outrage after network failures that led to three deaths – when people couldn’t call the emergency ‘000’ line.

Now, Dapto.

Optus is investigating a network outage that led to nine failed triple-0 calls near Wollongong on the NSW south coast. It issued a statement saying the problem stemmed from a mobile phone tower site in Dapto.

The outage affected calls between 3am and 12:20pm on Sunday, including calls to the triple-0 network. One caller required an ambulance but then managed to get through using another phone.

The telco says it has confirmed with police that all callers who tried to contact emergency services are OK. About 4,500 people were affected by the Dapto outage and Optus has apologised to affected customers. Service to the area has now been restored.

The government has asked the Australian Communications Media Authority (ACMA) to investigate. The latest incident comes just 10 days after a disastrous outage that led to hundreds of failed triple-0 calls. The deaths of three people have been linked to that outage and the Australian Communications Media Authority has launched an investigation.

ACMA has also confirmed it will investigate the latest incident, and the probe will be separate to its inquiry into the September 18 outage.

The regulator said it was “alarming” that another outage had occurred so soon after the previous incident.

Why the September slump has only hit the ASX while other global markets gain

What’s going on in the market?

Loading…

Head of client coverage, Pacific, at FTSE Russell, Julia Lee, says the tech rally has carried global markets to gains in the last quarter including September, which is traditionally a challenging time for markets, but the sector is simply too small on the ASX to pull the market into positive territory.

Optus CEO meeting Communications Minister

The tragic consequences of repeated triple-0 outages will be the topic of discussion when Communications Minister Anika Wells meets with Optus boss Stephen Rue and chief executive of the telco’s parent company, Singtel, Yuen Kuan Moon today.

An outage in the emergency network on September 18 has been linked to the deaths of three people.

(When you call the emergency number – 0 0 0 or ‘triple zero’ – you are meant to be placed via any network. Meaning even if you pay Optus for mobile connection, the call can go through Telstra or whichever network is strongest and available where you are. Because it’s an emergency, right? That didn’t happen).

There was also another outage affecting triple-0 calls on Sunday near Wollongong on the NSW south coast, which led to nine failed calls.

Ahead of the meeting, Environment Minister Murray Watt said Wells was prepared to “lay down the law” with Singtel.

“I’m very confident that Anika will really lay down the law the parent company, [Singtel], CEO,” he told Nine.

“She’s obviously already had discussions with Optus themselves, but escalating that now to the parent company demonstrates how seriously we are taking this.”

My colleague David Taylor has a read on how we got to here.

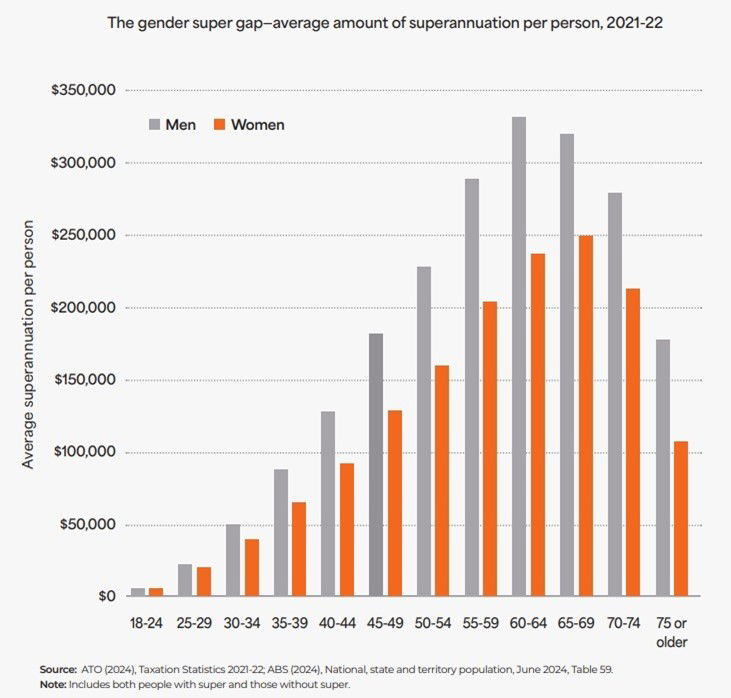

Women have less super at every stage of life

New research points to a looming crisis of older women entering retirement in poverty, unless urgent action is taken.

The report from the Super Members Council (SMC) has found while the so-called “superannuation gender gap” has often been blamed on having children, events later in life also have a disproportionate impact on women.

The report by Impact Economics and Policy was commissioned by SMC.

It found events such as separation, unpaid caregiving for older family members and family violence affected super balances, worsening women’s economic insecurity.

This could potentially result in up to $95,000 less in super for women.

SMC CEO Misha Schubert said the report was a wake-up call for all policymakers with its compelling insights.

“Australia has made important strides in recent years on the gaps in pay, super and workforce participation, but this research shines a spotlight on the need for further bold reforms to ensure our retirement system truly works for women — especially low-income women.

“Without urgent action, generations of Australia’s lowest-paid women risk poverty in retirement.”

Great read from my colleague, business reporter Yiying Li.

Hold on, wasn’t there a 96% chance of something happening that didn’t?

There is a 96% chance of no rate cut happening today.

However, I do recall in recent months there being a 100% chance of a rate cut happening at one of the meetings and it did not end up occurring. 96% although means highly likely, does not mean certain by any measure

– LK

Good call LK.

Yes, in July the RBA shocked markets by holding rates steady.

Here’s my wonderful colleague Stephanie Chalmers reporting from that surprising day:

“The Reserve Bank has not delivered an interest rate cut in July as had been widely forecast, but has indicated it expects to cut rates further from here.

“The RBA kept the cash rate on hold at 3.85 per cent, in a decision the central bank’s governor described as more about “timing than direction” of rates.

“The decision defied financial market expectations, which had priced in a 96 per cent chance of a 0.25 percentage point cut, and economist forecasts.

“Forecasts had shifted almost unanimously in favour of a cut, after the latest inflation data showed consumer prices rising less than expected in May, while economic growth slowed in the first quarter of the year.”

When the minutes of the RBA meeting came out, two things were revealed.

The first was a split 3-6 vote (Six voting “hold”, three voting “cut”). Unlike normal markets and democracies, we’ll never know who voted which way because the RBA keeps that information secret.

The other element was a plan for “cautious and gradual” rate cuts that clashed with a “surge” in unemployment.

You can read more here:

Compulsive switcher makes fair point about switching

Former finance journalist, Sunrise host and Port Adelaide FC David “Kochie” Koch makes a reasonable point as part of his new role at aggregator Compare the Market.

Sites like that one — and there are plenty of others — generally offer a comparison service that puts options for financial products like loans, mobile phone plans and insurance. They are typically paid a percentage or a fee for products they point people towards, by the originating company.

Anyway, back to the non-individual general financial advice.

“So many home owners are holding out for rate relief but it’s unlikely the Reserve Bank will deliver that (today).

“But that doesn’t mean that a lot of people can’t start saving anyway. The average interest rate for outstanding loans is 5.76%. Right now, there are variable rates from 5.34% – that could be a saving of about $179 a month, surpassing what a typical RBA cut would deliver.

“Plus, there are two-year fixed rates as low as 4.79%. That’s the lowest we’ve seen in years and could be a smart option if you’re looking to start saving now and lock in some certainty for the months ahead.”

The point here is about the “loyalty penalty” customers pay by not shopping — and shifting — their accounts around.

It’s a pain, it can take a while, but it does seem to be worth it.

This is in insurance, phone plans, bills — it is endless.

When it comes to the biggest of debts, people are doing it.

About 65,000 home loans were refinanced by borrowers moving to different lenders in June 2025, a 25% increase on the previous year. Australian Bureau of Statistics (ABS) data shows that around 43,000 loans were refinanced with the same lender, up 30.7% for the year.

That means people calling up and saying: “Hey, why is my rate higher than the one you’re offering newbies who walk in the door?”

It’s a good question. The answer is the loyalty penalty.

And you don’t have to pay it.